Cash Advance — UnScrewed

Find loan options that actually fit your situation and track your finances in one simple app. No pressure, no confusion — just clear offers and better money decisions.

Find loan options that actually fit your situation and track your finances in one simple app. No pressure, no confusion — just clear offers and better money decisions.

Smarter loan matching, built-in budgeting, and a clean dashboard — designed to reduce stress, not add to it.

Get connected with loan options based on your real financial needs — not generic promises. We focus on relevance, transparency, and responsible matching rather than volume.

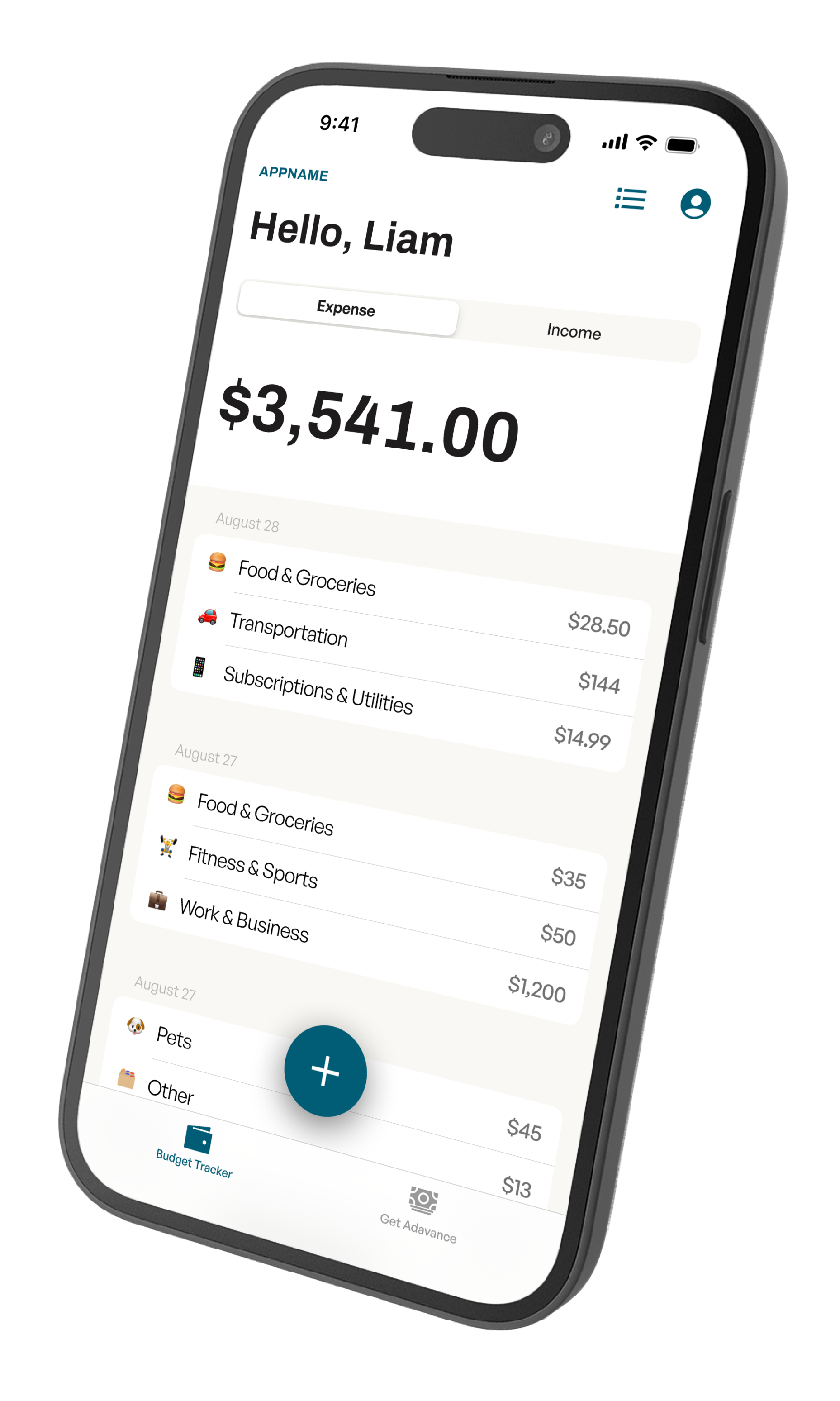

Track income and expenses in one place to clearly understand your cash flow and plan smarter financial moves ahead.

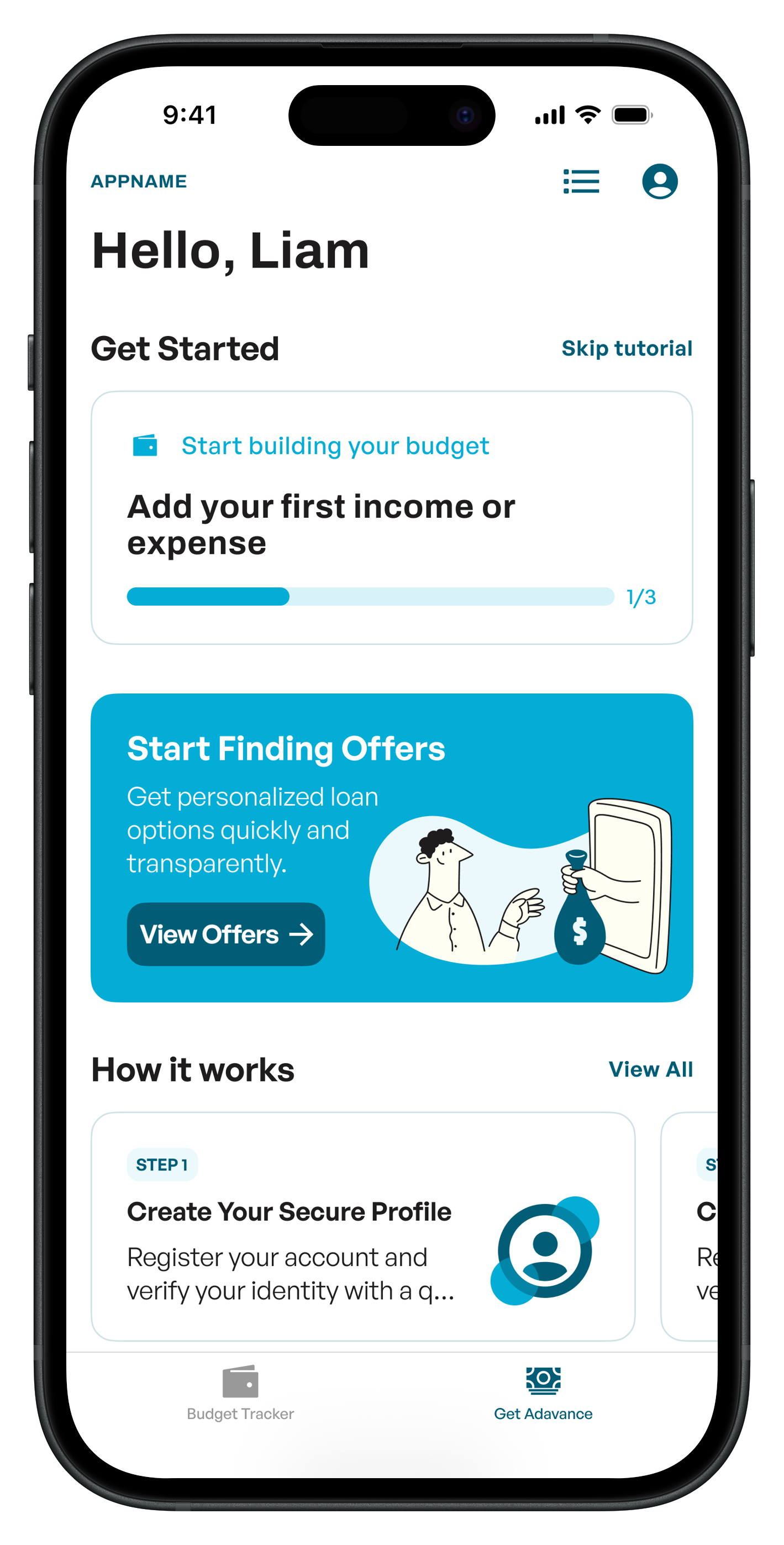

From loan requests to financial activity — manage everything from a clean, intuitive account designed to reduce stress, not add to it.

Sign up, customize your request, and explore your options — all in minutes.

Sign up and verify your information to create a secure account. We connect you with trusted, licensed lending partners while keeping your data protected.

Choose your desired loan amount and share a few key financial details. Accurate information helps improve the quality and relevance of your loan matches.

Explore available loan options with clear terms, repayment details, and real-time status updates — all in one place, at your own pace.

Record your income and expenses to see the full picture of your finances. The built-in budget tracker helps you:

No spreadsheets. No guesswork.

Inside your personal account, you can:

Clean layout. No clutter. No unnecessary steps.

We focus on responsible financial tools that help you make informed decisions without rushing or confusion.

Instead of pushing generic offers, we connect you with loan options that align with your stated needs. You review real terms, compare options, and decide on your own timeline.

Loans are only one part of your financial picture. Budget tracking tools help you understand income, expenses, and obligations so you can see how borrowing fits in.

Your information is protected with industry-standard safeguards. We work only with trusted partners and do not sell personal data for unrelated marketing.

There is no obligation to accept any offer. Clear language, a clean interface, and transparent statuses remove uncertainty. You always know where you stand.

Explore loan options responsibly, track your budget, and manage your financial activity in one place — on your terms.